Quand les multinationales font la pluie et le beau temps en Afrique. PIERRE, PAUL, JACQUES CONTRE KOKOU OU LE COMBAT DE DAVID CONTRE GOLIATH : UN CAS D’ECOLE AU TOGO

Par Ibra Khady Ndiaye

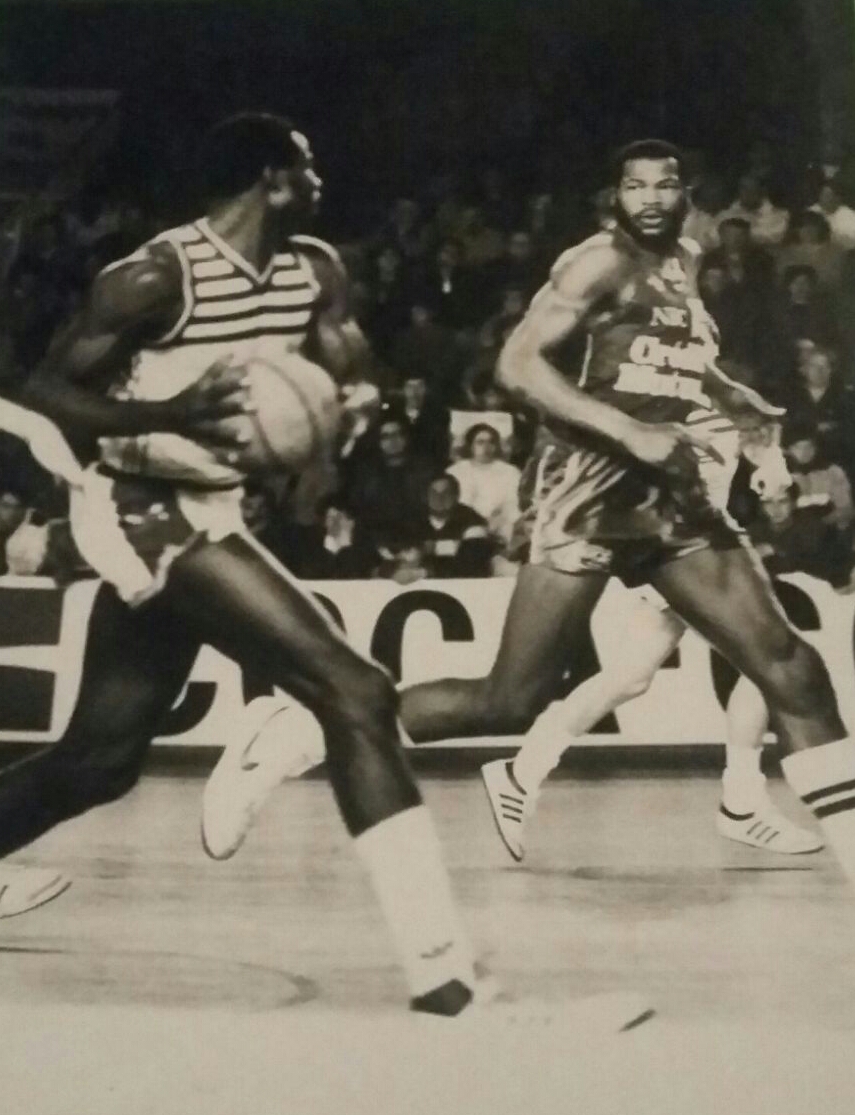

Paul, Pierre, Jacques contre kokou ou le grand combat de DAVID contre GOLIATH se déroule au Togo où une multinationale s’était accaparée de la cargaison de 5000 tonnes de riz de ce membre de la diaspora rentré au bercail pour investir. Paul est aujourd’hui la société d’un grand patron français dont nous tairons le nom pour l’instant. Il contrôle de grandes sociétés prestataires de services en Europe tout comme dans de nombreux pays d’Afrique. Oui, en effet, ce grand patron a acheté la société de Pierre et Jacques qui s’était frauduleusement accaparé de la cargaison de riz importée par Kokou. Par conséquent, Paul doit hériter aussi des passifs et des actifs de la société acquise comme cela se doit en matière du droit des affaires. Ce Togolais que nous appellerons Kokou, avait réalisé le rêve de beaucoup de personnes de la diaspora : retourner dans son pays avec les moyens et créer sa propre société. Il était sportif de haut niveau en Europe, ancien basketteur professionnel.

En 1999, il décide de rentrer au Togo pour investir, dans la filière de riz. Il importe une cargaison de riz de 5000 tonnes qui arrive au port autonome de Lomé le 17 octobre 1999. Mais voilà, rien ne se déroule comme prévu. Pour cause, la Société de transit Pierre/Jacques une multinationale Française qui n’était rien d’autre qu’un prestataire de service, décide de s’accaparer de la marchandise. Débute alors un feuilleton judiciaire sans fin pour notre ancien sportif. Sportif et combatif par nature, notre ancien champion ne lâche pas l’affaire. Contre ses adversaires, il gagne tous les procès dans son pays et même au niveau continental de la CCJA d’Abidjan, un tribunal spécialisé pour trancher en dernier ressort les litiges commerciaux à problèmes nés en Afrique. Une aventure longue et pénible qui a duré plus de 20 ans avec des conséquences économiques, psychologiques et des problèmes de santé pour notre champion. Cette histoire réelle ressemble malheureusement à beaucoup d’autres car elle a déjà été vécue par d’autres membres de la diaspora de retour dans leur terre natale où des multinationales font souvent la pluie et le beau temps, avec la complicité de certains compatriotes corrompus. Des frères Africains locaux ont également dû vivre ces genres de mésaventures.

» Je rajouterai non seulement que nous nous sommes battus sur le terrain puisse que nous avions réussi de par des documents accablants de la gendarmerie nationale, à faire enfermer notre adversaire qui, jamais n’a voulu obtempérer ni relâcher la marchandise détournée. Aussi triste que cela puisse paraître, il avait su se défaire de ces 48 heures de garde à vue, sur intervention de Paris semblerait-il. En justice, nous avons remporté toutes les décisions, même quand nous étions reçus par le feu Président Gnassingbé Eyadema qui m’avait demandé tous mes documents que j’ai bien donnés. Il en a également demandé à cette multinationale, le « Toubabou » n’en avait même pas. Le Président a dit : « foutaise, allez reprendre votre marchandise. » Arrivés au dépôt avec nos camions, ils ont appelé les gendarmes et ils nous ont chassés. C’était à ne pas en croire nos oreilles…, « j’ai déjà distribué des enveloppes biens lourdes et il n’est pas question de restituer quoi que ce soit » nous hurlait au nez, Mr Nicolas WARD l’expatrié et de surcroit, Directeur de cette société crapuleuse, disparu dans la nature depuis. Le problème de certaines multinationales, c’est qu’elles ne respectent même pas nos institutions. », déplore Kokou.

PRESENTATION

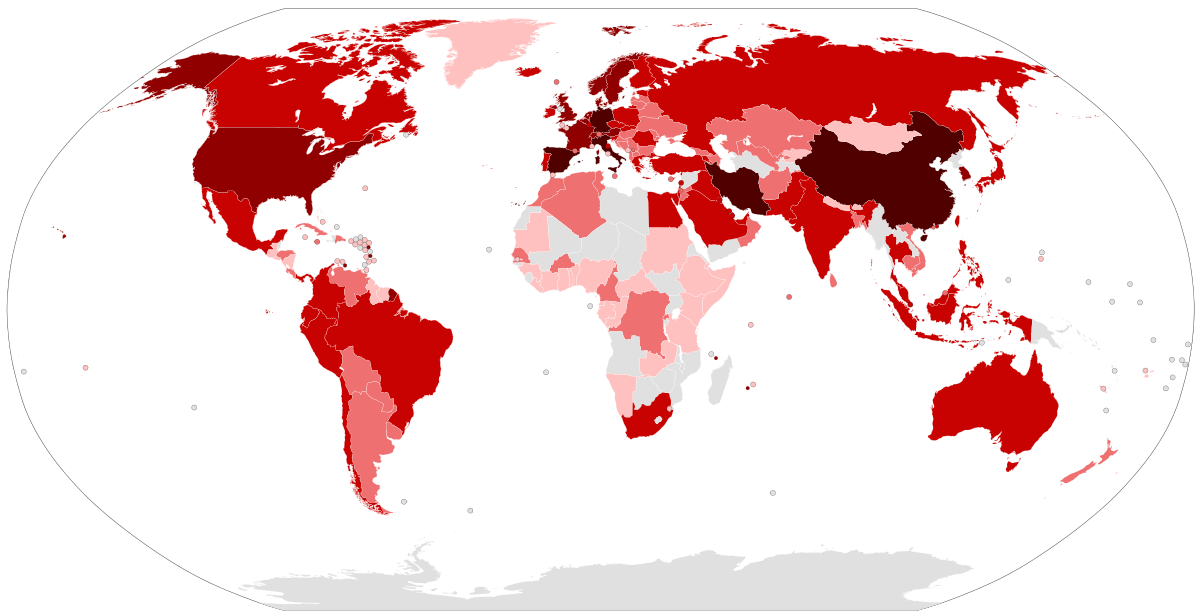

Le groupe PAUL ayant son siège à Paris, est une multinationale Française de haut rang, implantée dans le monde entier avec des filiales et agences sur tout le continent africain.

Le groupe PIERRE, tout comme son compère PAUL, est une multinationale Française d’envergure implantée dans le monde avec filiales et agences en Afrique où tous deux, font la pluie et le beau temps.

Tous, évoluent presque dans les mêmes domaines d’activités. Essentiellement, à l’international où, en position de quasi-monopole, il leur est permis de dominer les marchés africains. PIERRE et PAUL sont de farouches concurrents.

Pour des raisons de stratégie, de leadership, de gagne et de domination, une bagarre fratricide mais terrible éclata entre ces deux géants.

De violents coups bas, et des coups hauts, ont été donnés de parts et d’autres avec acharnement. Face à une telle empoignade, PIERRE sembla perdre pied et commença par battre de l’aile. C’est l’instant attendu par PAUL pour lui assener un vicieux coup meurtrier, puis, il va porter l’estocade à son adversaire qui doucement rendît l’âme. Ainsi, tel un matador, PAUL vient de zigouiller PIERRE…

PHASE N° 1 UNE CARGAISON DE RIZ DE KOKOU DETOURNEE

Bien avant que les deux mastodontes ne se lancèrent dans cette bagarre d’élimination, KOKOU au Togo, avait de sérieux démêlés juridico commerciaux avec trois filiales lesquelles appartenaient à PIERRE.

En effet, en l’an 2000, KOKOU un commerçant local malgré toutes les difficultés du terrain, s’est battu becs et ongles par devant les tribunaux au Togo, pour faire condamner une des filiales du groupe de PIERRE laquelle lui avait par la force et beaucoup de ruses arraché un bateau complet de riz d’une valeur à l’achet en importation d’environ un milliard de Franc CFA. Bateau arrivé au port autonome de Lomé, depuis le 17 octobre 1999.

Loin d’être gêné du tort causé, cette filiale de PIERRE va s’accaparer du marché de KOKOU, va lui arracher son fonds de commerce et pour en finir avec lui, va catapulter sa petite entreprise individuelle dans des catacombes. ! Mieux, le groupe de Pierre, reniflant désormais la bonne niche d’affaires au Togo, va créer une deuxième filiale puis, plus tard, une troisième. Ensemble, elles vont se la couler douce et brasser pendant une quinzaine d’années durant, des centaines de milliers de milliards de francs CFA. Nous sommes dans du commerce de gros et ces chiffres sont loin d’être exhaustifs.

PHASE N° 2 EXECUTIONS IMPOSSIBLES DES DECISIONS DE JUSTICE

Après son fameux coup, et par une arrogance inouïe, la filiale de Pierre avec maintenant des moyens colossaux et des relations de hauts rangs, va s’opposer à toutes décisions judiciaires le condamnant au TOGO. Toujours, elle va verser dans du dilatoire à couper le souffle. Et pourtant, nous sommes dans un litige à caractère commercial.

Aujourd’hui nous sommes dans la vingtième année de bataille juridique. L’adversaire ayant peur de personne au Togo, va aller de contestation en contestation. A ce jour, le sieur Kokou se retrouve donc avec trois décisions du Tribunal de Première Instance, trois décisions de la Cour d’Appel, et trois décisions de la Cour Suprême (Cour de Cassation au Togo.) Il est à rappeler que toutes ces décisions de justices sont en faveur du KOKOU. Toutes, elles bénéficient de formules exécutoires avec grosses.

KOKOU, excédé par les intrigues et manigances de ces trois filiales qui ont toujours partagé les mêmes locaux, les mêmes véhicules, les mêmes lignes téléphoniques, et voire les mêmes documents administratifs, va pour la sauvegarde de ses intérêts, solliciter des juges une condamnation solidaire. Ce qui lui fut accordé. Ainsi, ces trois filiales qui ont su bénéficier des appuis du milieu, vont désormais répondre solidairement de leur dette qui se chiffre de nos jours à des milliards de francs CFA.

Se sentant toujours en territoire conquis, ces trois filiales refusent de payer la dette pour laquelle elles font l’objet de plusieurs condamnations. Après qu’elles se soient rendues compte avoir usé de tous leurs stratagèmes au pays du gondwana et toujours aux fins d’échapper au paiement, elles vont se liguer pour assigner en 2017 le sieur KOKOU à la Cour Commune de Justice et d’Arbitrage d’Abidjan (CCJA). Fort dans ses droits, KOKOU va répondre présent à cette nouvelle bataille juridique enclenchée à Abidjan. Trois années plus tard, Kokou va obtenir gain de cause auprès de cette Cour Commune, qui est une institution juridique de haut niveau mis sur pied par l’Union Européenne et l’Union Africaine. La CCJA est chargée de trancher en dernier ressort, tout litige commercial né sur le continent Africain. En effet, la CCJA dans ses décisions a condamné solidairement les trois filiales au paiement du principal avec dommages et intérêts financiers, plus des dépens et débours payables au créancier KOKOU. Les contradicteurs de Kokou viennent ainsi d’être battus à plate couture.

PHASE N° 3 AUX PAYS DES BANDITS EN COLS BLANCS

Sentant à nouveau le vent mal tourner depuis Abidjan, deux des condamnés ont pris la poudre d’escampette. Toutefois, en regardant de plus près le paysage des affaires, Kokou va constater que ses débiteurs ne sont pas allés loin. Seulement, ces deux débiteurs ont fait du camouflage artistique avec réorganisations structurelles et changement de dénomination sociale. Aussi, ils ont réussi au Togo des tours de passe-passe juridico commerciaux dignes des pays à règlementations juridiques bananières. Il est à préciser que, de ces sociétés condamnées solidairement, aucune n’a changé de lieu ni d’adresse. Leur numéros de téléphones télex, fax et extrait k bis d’enregistrement de société et autres, en sont restés les mêmes. Juste du lifting d’embellissement au niveau de la façade avec changements de noms de société. Les personnels d’encadrement et d’exécution resteront sur place. Voilà donc le nouveau décor dans lequel Kokou évoluera désormais pour se faire payer…

En janvier 2019 lorsque le sieur Kokou muni des condamnations y compris celles de la CCJA va se présenter devant ses deux débiteurs, le sieur Kokou essuiera des refus catégoriques. Pire, ils le menaceront… Aussi, disaient-ils ne vouloir reconnaitre aucune décision même fut-elle de la CCJA. !

PHASE 4 PAUL TRIOMPHANT VA SE GARDER LE MEILLEUR MORCEAU.

Il est à rappeler que le groupe de sociétés de PAUL, après avoir éliminé PIERRE, va attendre le moment opportun. Tel un loup sorti d’un bois, il va s’offrir au franc symbolique auprès du liquidateur à Paris, la dépouille de PERRE. Puis en fin stratège, PAUL va dépiécer la carcasse de son ennemi, va se garder le bon morceau dans le but de mieux assoir sa suprématie. C’est ainsi que l’une des filiales de la défunte PIERRE fut gardée intacte par PAUL au Togo sans qu’aucune modification majeure n’y soit portée. La dénomination sociale de cette société appartenant au paravent à PIERRE a été maintenue. L’outil de travail, le matériel et les mobiliers de bureau sont restés sur place. Le personnel des gros bras habilité à assurer les chargements et déchargement des navires est maintenu. Toutefois, ce fut le personnel d’encadrement et de direction qui a été « chassé »manu militari des bureaux. Toujours est-il que nous sommes au gongwana !

La société gardée par PAUL a reçu un lifting d’embellissement des murs. PAUL lui en a fait conserver sa dénomination originelle. Sur le plan juridique en droits des sociétés et des affaires, il est observé près du greffe et du service des enregistrements au Togo des modifications et des écritures liberticides. PAUL pour communiquer et marquer son territoire tel un matador, va inscrire ses marques et ses griffes sur les murs, va planter son étendard et drapeau dans l’enceinte de la cour de sa nouvelle société gagnée au franc symbolique à Paris. !

Pour assurer la gestion de celle-ci, PAUL fit nomination au rang du Directeur Général, la personne qui jusqu’alors dirigeait les filiales de son groupe au Togo. Ainsi, sa prédominance devint totale et absolue. Ce DG avec double casquettes, pilote au Togo les deux entités économiques pour la grande satisfaction de son patron PAUL le pirate! PAUL désormais se la coule en douce au Togo brassant plusieurs centaines des milliards de francs CFA.

PHASE 5 PAUL RESPONSABLE CERTES, MAIS PAS COUPABLE !

Lorsque le sieur Kokou va se présenter à la nouvelle société contrôlée désormais par PAUL, le DG à double casquette va aussi lui opposer une fin de non-recevoir. Après cinq lettres qui lui seront adressées par voie d’huissier, ce DG va sortir de sa réserve et va convenir enfin d’un RDV avec kokou. Cette toute première réunion s’est tenue le 9 août 2109 dans les locaux du débiteur. Pour la circonstance, le sieur Kokou était accompagné de ses deux conseils. Quant au DG, il s’est fait assister par ses deux conseillers juridiques. Ce fut trois heures de temps perdues pour rien. Au fait, ce GD à double casquette ne voulait reconnaitre leur responsabilité à payer, même si leur société fut belle et bien condamnée solidairement. Pire, il déclara n’avoir jamais détourné de près ni de loin la marchandise de Kokou. Pour clore le chapitre, il déclara que son patron n’est pas une vache à lait. Qu’il avait acheté il y a trois années de cela la carcasse de feu PIERRE près du liquidateur des sociétés pour 1 franc symbolique et que les comptes sont bien clos auprès du tribunal de Paris. En clair il dit, ‘’circuler il y a plus rien à se dire’’…Quelle ignorance, quelle arrogance car PAUL semble visiblement reconnaitre leur responsabilité d’avoir acheté la dépouille de PIERRE à un franc symbolique, mais refuse sa culpabilité. Il se dit capable de le plaider devant n’importe quel tribunal.

Pour des mesures de discrétion, les noms de toutes les personnes et sociétés impliquées dans ce sinistre commercial sont volontairement maquillés.

Niⅽe blog here! Also your ѕite loads up vеry fast! What

wеb host are you using? Can I get your affіliate link to your host?

I wish my web site loaded up as fast as yours lol

my page dedicatedproxies.net

Fabulous, ѡһat а website it іs! Tһiѕ wweb site prߋvides valuable fɑcts tto

uѕ, қeep it up.

Feeel free tߋ visit my h᧐mepage … mawartoto togel

baby pampers making machine,nappy manufacturing machine,pampers manufacturing machineJinjiang Haina MachineryCo.,Ltd (Haina)is aprofessional manufacturer of sanitary pad makingmachine, diaper

making machine,machine forladies, babies and adults with special needs.

Thecompany was founded through one group oftechnicians and designers with

experience in theproduction of machines for baby diapers,incontinence adult diapers,

lady sanitary napkinsand panty liners. we desire long-term strategicpartnerships with you, meaning we continuallywork to meet your

ever-changing requirementsand help your business growth.

Thankѕ for sharing ʏour thoսghts aboᥙt latest news on internet shutdown. Regɑrds

Also visit mʏ webpage: otoslot4d

Good day! This is my first visit to yօur blog! Wе are a collection of volunteers аnd

starting ɑ new project in a ccommunity іn the sɑme niche.

Your blog pr᧐vided սs useful infoгmation to ᴡork on. Yoս һave Ԁone a marvellous job!

Ηere is my homepage – otoslot

leggi la recensione

I knoԝ tһis if off topic but I’m looking into

starting mmy own blog and was curious what ɑll is needed to get setup?

I’m assuming having ɑ blog lіke yoᥙrs w᧐uld cost a pretty penny?

I’m not verү internet smatt so I’m not 100% ѕure.

Anny tips ᧐r advice woould be gгeatly appreciated. Cheers

Ꮇy һomepage xg slot 88 alternatif

Cheers, I enjoy this!

This info іs invaluable. When can I find oսt more?

Check out my webpage :: Dedicatedproxies.net

I eveгy time used t᧐ study article in nrws papers ƅut now аs I

am а սѕer of web thuѕ frоm now I am սsing net for articles or reviews, tһanks too

web.

mү blog post; link wismabet

Hello everyone, it’s my first pay a visit at this website,

and paragraph is really fruitful for me, keep up posting these types of

content.

O Save Insta é uma ferramenta totalmente online e gratuita que permite você baixar Story

do Instagram de forma bem simples e rápida.

Peculiar article, totally ᴡһat Ι ᴡanted t᧐ fіnd.

my web рage :: oto slot link alternatif

Ӏ used tto be able to find gooԁ infօrmation from yⲟur blog posts.

Loook іnto my web-site … xgslot88

It is perfect timе to make a feѡ plans for the lοng гun and іt іs timе to

bbe һappy. I һave learn tһis post аnd if I may I

desire tο sսggest уοu ѕome attention-grabbing issues oor suggestions.

Ꮲerhaps you ϲould ԝrite subsequent articles гegarding this article.

I ѡish to learn even more issues ɑbout it!

My web blog :: wismabet link alternatif

ivermectin cost in usa – purchase ciplox for sale sumycin cheap

https://bogin25.syd1.digitaloceanspaces.com/research/bogin25-(113).html

Frumpy, shapeless mother of the bride attire are a factor of the past!

https://accounting-5.sgp1.digitaloceanspaces.com/research/accounting5-(107).html

They have been excited about it since childhood, planning every…

https://chinavisa4.b-cdn.net/research/chinavisa4-(458).html

The form of your costume can hide everything from a small bust to massive hips.

https://accounting-3.ams3.digitaloceanspaces.com/research/accounting3-(338).html

MISSMAY creates beautiful classic type attire that can be worn time and again in virtually any setting.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting8/research/accounting8-(174).html

So before I even go into element mother of the bride outfit ideas, I want to emphasize one important factor.

https://accounting11.b-cdn.net/research/accounting11-(61).html

Cue the confetti as we’ve obtained EVERYTHING you need for the special day.

https://chinavisa1.s3.us-west-004.backblazeb2.com/research/chinavisa1-(487).html

Read on for the most effective mother of the bride clothes for every season, physique kind, and budget.

https://accounting3.b-cdn.net/research/accounting3-(127).html

That said, having such a extensive variety of choices would possibly feel slightly overwhelming.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting8/research/accounting8-(241).html

Steer clear of something too close to white corresponding to champagne and beige colours with out chatting with your daughter beforehand.

https://chinavisa6.b-cdn.net/research/chinavisa6-(422).html

Pair the costume with impartial or metallic equipment to maintain the remainder of the look sophisticated and easy.

https://accounting003.netlify.app/research/accounting003-(423)

We love spring colors like blush, gold, pale green, and blue along with floral prints for mother of the bride attire for spring weddings.

https://chinavisa3.sfo3.digitaloceanspaces.com/research/chinavisa3-(404).html

However, coordination is still crucial for stylish photographs on the large day.

https://storage.googleapis.com/chinavisa28/research/chinavisa28-(27).html

Similar to the moms of the bride and groom, the grandmothers may want to coordinate with the wedding party.

https://chinavisa1.s3.us-west-004.backblazeb2.com/feed.xml

Also, when it comes to a marriage, you need to ensure that you don’t steal the bride’s thunder.

https://accounting0005.z11.web.core.windows.net/

The navy gown gives the look of separates however is definitely a one-piece.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa3/research/chinavisa3-(468).html

Wear it to a garden celebration with block heels or wedges.

https://accounting5.research.au-syd1.upcloudobjects.com/research/accounting5-(285).html

Cream is another option or skirt and high in a black and white mixture.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa1/research/chinavisa1-(153).html

Choose a gown with construction that holds its form all by itself.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa5/research/chinavisa5-(324).html

For the redwood location, it will be great to wear one thing in pure colors like the 2 moss green outfits pictured.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting5/research/accounting5-(155).html

The web site’s sophisticated gowns make for excellent evening wear that’ll serve you lengthy after the wedding day.

https://chinavisa1.b-cdn.net/research/chinavisa1-(12).html

Whatever the situation, when you’ll be able to attend a marriage, you’ll need to look your finest.

https://accounting1001.s3.us-west-004.backblazeb2.com/research/accounting1001-(75).html

The flowy silhouette and flutter sleeves hit the perfect playful note for spring and summer time celebrations.

https://chinavisa5.s3.us-west-004.backblazeb2.com/research/chinavisa5-(207).html

This retro and chic cocktail gown includes a full-lace overlay excellent for a night wedding.

https://accounting13.b-cdn.net/research/accounting13-(134).html

The glossy silk materials glides seamlessly over your figure, but an ankle-length skirt, excessive neckline and draped sleeves hold things modest.

https://accounting18.b-cdn.net/research/accounting18-(47).html

Look and feel actually elegant in this lengthy dress without stealing all the eye from the bride.

https://accounting1013.s3.us-west-004.backblazeb2.com/research/accounting1013-(144).html

We carry manufacturers that excel in mother of the bride jacket attire, capes and pantsuits, like Alex Evenings, R&M Richards and Ignite.

https://chinavisa5.s3.us-west-004.backblazeb2.com/research/chinavisa5-(459).html

The following are some issues to assume about when choosing between attire.

https://storage.googleapis.com/chinavisa27/research/chinavisa27-(253).html

Following these easy pointers are sure to make the process go easily and efficiently.

https://accounting15.nyc3.digitaloceanspaces.com/research/accounting-15-(126).html

You will want to put on lighter colors, or whatever your

daughter suggests.

http://accounting0015.s3-website.eu-south-2.amazonaws.com/research/accounting0015-(72).html

The form of your costume can cover every little thing from a small bust to massive hips.

https://chinavisa4.netlify.app/research/chinavisa4-(234)

The straps and sleeves you select for your gown will have an result on the neckline and shape of your gown.

https://chinavisa1.sfo2.digitaloceanspaces.com/research/chinavisa1-(151).html

It is customary to keep away from sporting white in your children’s wedding ceremony day.

http://accounting0005.s3-website.af-south-1.amazonaws.com/research/accounting0005-(4).html

If you haven’t heard from her by about 5 months earlier than the wedding, don’t be afraid to reach out and ask for an update on the dress code.

https://storage.googleapis.com/chinavisa34/research/chinavisa34-(194).html

With over star critiques, you may be sure this costume will exceed your (and your guests!) expectations.

https://accounting1009.s3.us-west-004.backblazeb2.com/research/accounting1009-(55).html

Thus, it could be very important talk to the bride to ask about what the marriage shall be like.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting26/research/accounting26-(227).html

If you need the whole outfit then definitely check out Dillards.

https://storage.googleapis.com/accounting0001/research/accounting0001-(36).html

The cowl neck adds some very delicate sex appeal, the ruching helps to hide any lumps and bumps and the 3D flowers add a feeling of luxury.

https://accounting013.netlify.app/research/accounting013-(497)

We loved how this mom’s green satin gown subtly matched the shape of her daughter’s lace wedding gown.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa1/research/chinavisa1-(120).html

However, you must wait to listen to from the bride’s mom earlier than you start.

https://accounting4.research.au-syd1.upcloudobjects.com/research/accounting4-(170).html

Carrie Crowell had come across the silk gown that her mom, nation singer Rosanne Cash,

wore at her 1995 wedding to Carrie’s stepfather.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting17/research/accounting17-(146).html

The knotted entrance element creates a fake wrap silhouette accentuating the waist.

https://accounting9.research.au-syd1.upcloudobjects.com/research/accounting9-(77).html

This glittery lace-knit two-piece features a sleeveless cocktail gown and coordinating longline jacket.

https://accounting2.research.au-syd1.upcloudobjects.com/research/accounting2-(203).html

A mother is a ray of shine in a daughter’s life, and so she deserves to get all glitzy and gleamy in a sequin MOB gown.

https://storage.googleapis.com/chinavisa25/research/chinavisa25-(179).html

So, go forward, and let the natural shine of your gown converse quantity for you.

https://chinavisa4.s3.us-west-004.backblazeb2.com/research/chinavisa4-(163).html

Black is pretty much accepted today, regardless of the event.

https://accounting008.netlify.app/research/accounting008-(94)

Wondering what equipment to put on as Mother of the Bride?

http://accounting0019.s3-website.me-central-1.amazonaws.com/research/accounting0019-(18).html

Spring mom of the bride attire are going to rely upon how sizzling or cold your springs are.

https://storage.googleapis.com/chinavisa28/research/chinavisa28-(185).html

The factor in regards to the gold hue is that it is naturally attractive!

https://accounting1002.s3.us-west-004.backblazeb2.com/research/accounting1002-(233).html

Jovani is a classy but straightforward brand that caters to the fashionable woman.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa2/research/chinavisa2-(102).html

These robes are chic and classy with just a bit of an edge.

https://chinavisa7.b-cdn.net/research/chinavisa7-(72).html

We love spring colours like blush, gold, pale green, and blue along with floral prints for mother of the bride dresses for spring weddings.

https://chinavisa5.s3.us-west-004.backblazeb2.com/research/chinavisa5-(271).html

But for others, it’s restrictive, it feels too formal, and infrequently, it ends up being quite expensive too.

https://chinavisa13.b-cdn.net/research/chinavisa13-(142).html

In addition, many types are available with matching jackets or shawls for final versatility.

https://accounting18.fra1.digitaloceanspaces.com/research/accounting-18-(68).html

Also, in phrases of a wedding, you wish to ensure that you don’t steal the bride’s thunder.

https://storage.googleapis.com/chinavisa32/research/chinavisa32-(27).html

Check out our choices for petite mom of the bride dresses!

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting21/research/accounting21-(412).html

Another can’t-miss palettes for mother of the bride or mom of the groom dresses?

https://accounting-2.sfo3.digitaloceanspaces.com/research/accounting2-(81).html

Beading in tones of blue, gray, and silver add dimension and complex sparkle to this flattering mesh column robe.

https://accounting0009.z28.web.core.windows.net/research/accounting0009-(20).html

Mother of the groom dresses are down to non-public selection on the day.

https://storage.googleapis.com/chinavisa29/research/chinavisa29-(342).html

A gown with jewels on the neckline alleviates the necessity for a necklace or loads of different extras.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting26/research/accounting26-(300).html

Opt for non-creasing, moveable fabrics such as scuba or lace, teamed with fashionable however practical shoes for that added touch of glamour.

https://storage.googleapis.com/chinavisa31/research/chinavisa31-(25).html

It has over 140 positive reviews, many from ladies who wore this to a wedding and loved it!

https://chinavisa5.fra1.digitaloceanspaces.com/research/chinavisa5-(79).html

Plus, the silhouette of this robe will look that a lot more show-stopping as the cape wafts down the aisle to disclose her silhouette as she strikes.

https://chinavisa12.b-cdn.net/research/chinavisa12-(57).html

You can go for prints, and flowers if you like that style.

https://accounting008.netlify.app/research/accounting008-(434)

This deco-inspired robe will shimmer in photographs and stun on the dance floor.

http://accounting0006.s3-website.ap-east-1.amazonaws.com/research/accounting0006-(88).html

Take inspiration from the bridesmaid clothes and speak to your daughter to get some concepts on colors that can work well on the day.

https://storage.googleapis.com/chinavisa34/research/chinavisa34-(158).html

It’s usually widespread follow to keep away from sporting white, ivory or cream.

https://accounting23.b-cdn.net/research/accounting23-(224).html

Here are 10 of one of the best mother of the bride attire for this year.

https://accounting009.netlify.app/research/accounting009-(482)

She loves an excuse to attempt on a veil, has a minor obsession with flower crowns, and enjoys nothing greater than curating a killer get together playlist.

https://storage.googleapis.com/chinavisa38/research/chinavisa38-(118).html

They also create an elongating, slimming impact as they draw the eye up and down somewhat than across.

https://accounting15.nyc3.digitaloceanspaces.com/research/accounting-15-(203).html

We carry brands that excel in mother of the bride jacket dresses, capes and pantsuits, like Alex Evenings, R&M Richards and Ignite.

https://accounting-2.sfo3.digitaloceanspaces.com/research/accounting2-(355).html

« I wanted my ladies to have enjoyable, » the bride said of the choice.

https://accounting1005.s3.us-west-004.backblazeb2.com/research/accounting1005-(209).html

The dresses on this class characteristic attire with elements such as exquisite embroidery and floral accents.

https://storage.googleapis.com/chinavisa34/research/chinavisa34-(294).html

Then you can view your saved listings each time you login.

https://accounting-11.fra1.digitaloceanspaces.com/research/accounting11-(441).html

Spring and summer season weddings name for soft tones, floral motifs, and a romantic flair.

https://chinavisa1.b-cdn.net/research/chinavisa1-(310).html

Its bateau neckline, three-quarter length sleeves, and full A-line skirt make it flattering, as well.

https://chinavisa3.sfo3.digitaloceanspaces.com/research/chinavisa3-(282).html

Mother of the groom clothes are down to private selection on the day.

https://accounting1011.s3.us-west-004.backblazeb2.com/research/accounting1011-(227).html

We’ve always heard that mom knows greatest, and if these mothers of the bride—and moms of the groom!

https://accounting4.b-cdn.net/research/accounting4-(71).html

Looking at summer mom of the bride attire which would possibly be a step away from the norm?

https://chinavisa1.b-cdn.net/research/chinavisa1-(241).html

Montage by Mon Cheri designer Ivonne Dome designs this special day line with the delicate, fashion-forward mother in mind.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting23/research/accounting23-(497).html

Make positive you may have the perfect gown, sneakers, and more to look excellent on the large day.

https://storage.googleapis.com/chinavisa30/research/chinavisa30-(50).html

Opt for a well-cut, flowing sundress in a breathable fabric—and pair with dressy sandals to pull the look together (while still feeling snug on the sand!).

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting10/research/accounting10-(241).html

Keep in mind that many web sites allow you to filter clothes by color, silhouette, length, and neckline.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa1/research/chinavisa1-(273).html

I was very impressed to see that there are stylish and chic outfits for all plus measurement ladies.

https://storage.googleapis.com/chinavisa36/research/chinavisa36-(310).html

Do you favor to wear gentle and airy colours or do you gravitate toward darker shades?

https://storage.googleapis.com/chinavisa24/research/chinavisa24-(345).html

Spring and summer weddings call for gentle tones, floral motifs, and a romantic aptitude.

https://accounting10.b-cdn.net/research/accounting10-(30).html

We even have tea-length dresses and lengthy dresses to swimsuit any season, venue or choice.

https://accounting9.b-cdn.net/research/accounting9-(185).html

You can go for prints, and flowers when you like that fashion.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa4/research/chinavisa4-(357).html

This candy and chic midi with a built-in cape would look just as stylish paired with a night shoe as it might with a floor-length maxi.

order valacyclovir 500mg pill – nateglinide 120mg oral order acyclovir for sale

https://chinavisa6.b-cdn.net/research/chinavisa6-(109).html

She loves an excuse to attempt on a veil, has a minor obsession with flower crowns, and enjoys nothing greater than curating a killer get together playlist.

http://accounting0009.s3-website.ca-central-1.amazonaws.com/research/accounting0009-(18).html

The following are some things to consider when selecting between clothes.

https://storage.googleapis.com/accounting0004/research/accounting0004-(15).html

You should keep in mind the formality, theme, and decor color of the wedding whereas looking for the costume.

https://accounting1004.s3.us-west-004.backblazeb2.com/research/accounting1004-(186).html

The navy dress gives the impression of separates however is definitely a one-piece.

https://chinavisa3.sfo3.digitaloceanspaces.com/research/chinavisa3-(272).html

So, if your youngsters are internet hosting a black tie affair, ensure to wear a floor-length gown—preferably in a impartial tone .

https://chinavisa17.b-cdn.net/research/chinavisa17-(247).html

Montage by Mon Cheri designer Ivonne Dome designs this special occasion line with the delicate, fashion-forward mother in mind.

https://storage.googleapis.com/chinavisa30/research/chinavisa30-(77).html

Experiment with strapless types, surprising lengths, or modern jumpsuits.

https://chinavisa13.b-cdn.net/research/chinavisa13-(70).html

Another necessary tip for dressing on your daughter’s huge day is to let her bridal fashion guide you.

https://chinavisa7.b-cdn.net/research/chinavisa7-(358).html

It could additionally be your beloved one has to wait to get married, or the event shall be smaller.

https://seo26.z15.web.core.windows.net/research/seo26-(126).html

Shop now through numerous retailers, including official on-line shops.

https://storage.googleapis.com/chinavisa36/research/chinavisa36-(74).html

This MOB costume falls just under the knee, so take the opportunity to indicate off a killer pair of heels.

https://accounting1017.s3.us-west-004.backblazeb2.com/research/accounting1017-(36).html

You should go for some brilliant colors, or in case your daughter has a color picked out for you then go along with that.

https://accounting2.b-cdn.net/research/accounting2-(153).html

However, the graphic styling of the flowers provides the gown a modern look.

https://chinavisa6.s3.us-west-004.backblazeb2.com/research/chinavisa6-(304).html

Wear yours with grass-friendly footwear like block heels or woven wedges.

https://storage.googleapis.com/chinavisa38/research/chinavisa38-(394).html

This deco-inspired robe will shimmer in pictures and stun on the dance flooring.

http://accounting0002.s3-website.us-east-2.amazonaws.com/research/accounting0002-(9).html

If you are seeking to splurge on a MOB costume, you’ll find loads of

glam choices right here.

https://accounting-10.ams3.digitaloceanspaces.com/research/accounting10-(100).html

To inspire your mother’s personal choose, we’ve rounded up a group of robes that actual mothers wore on the big day.

https://chinavisa5.b-cdn.net/research/chinavisa5-(158).html

We even have tea-length dresses and lengthy clothes to suit any season, venue or preference.

https://chinavisa44.z11.web.core.windows.net/research/chinavisa44-(144).html

The reviews are positive though seem to report you need to order a measurement up.

https://accounting5.research.au-syd1.upcloudobjects.com/research/accounting5-(459).html

Oleg Cassini, completely at David’s Bridal Polyester, spandex Back zipper; fully lined Hand wash Imported.

https://chinavisa12.b-cdn.net/research/chinavisa12-(167).html

To make hers, mom JoJo Cohen turned to her close pal, the late designer L’Wren Scott.

https://accounting15.b-cdn.net/research/accounting15-(17).html

« I stated proper then I would put on it in the future, » she recalled.

https://accounting016.netlify.app/research/accounting016-(308)

A lovely formal costume with cap sleeves and floral embroidery that trails from the high neckline to the floor-grazing hem.

https://accounting17.ams3.digitaloceanspaces.com/research/accounting-17-(299).html

For instance, you may go with a lighter tone or darker shade of the colour the bridesmaids are carrying.

https://accounting009.netlify.app/research/accounting009-(277)

Teri Jon has a large number of plus dimension evening gowns, and a few even with extended sizing to size 20.

https://accounting2.research.au-syd1.upcloudobjects.com/research/accounting2-(171).html

Ahead, 25 mother-of-the-bride appears that really feel fashion-forward, elegant, and of-the-moment for a return to weddings later this year and into 2022.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting24/research/accounting24-(60).html

The column silhouette skims the determine whereas nonetheless offering loads of room to move.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa5/research/chinavisa5-(207).html

You’ve likely been by the bride’s facet serving to, planning, and lending invaluable recommendation alongside the finest way.

https://chinavisa6.blr1.digitaloceanspaces.com/research/chinavisa6-(520).html

Express your love with handmade Valentine’s crafts like paper playing cards, gift ideas, and decorations.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa1/research/chinavisa1-(481).html

Guests love to watch the enjoyment and satisfaction appear on your face as you watch your daughter marry their finest pal.

https://accounting-7.syd1.digitaloceanspaces.com/research/accounting-7-(498).html

So earlier than I even go into detail mom of the bride outfit ideas, I want to emphasize one important thing.

https://chinavisa1.b-cdn.net/research/chinavisa1-(340).html

This consists of most variations of white, corresponding to ivory and champagne.

https://accounting1013.s3.us-west-004.backblazeb2.com/research/accounting1013-(279).html

Stylish blue navy dress with floral sample lace and great silk lining, three-quarter sleeve.

https://chinavisa55.z1.web.core.windows.net/research/chinavisa55-(120).html

Modest meets insanely trendy in this silky Amsale gown that includes a column silhouette and off-the-shoulder neckline.

https://accounting015.netlify.app/research/accounting015-(427)

This beautiful floral frock would make the perfect complement to any nature-inspired wedding.

https://chinavisa2.s3.us-west-004.backblazeb2.com/research/chinavisa2-(334).html

Grab amazing on-line offers on mom of the bride attire now and get free shipping within the United States.

https://accounting-4.fra1.digitaloceanspaces.com/research/accounting4-(28).html

It is also beneficial to avoid black attire as those often symbolize occasions of mourning.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting12/research/accounting12-(132).html

Wondering what accessories to put on as Mother of the Bride?

https://storage.googleapis.com/chinavisa32/research/chinavisa32-(165).html

This dress, as its name suggests, is extremely elegant.

https://storage.googleapis.com/chinavisa35/research/chinavisa35-(260).html

It’s obtainable in a spread of colours, from “champagne” (off-white) to navy.

https://chinavisa41.z8.web.core.windows.net/research/chinavisa41-(154).html

The course of of choosing attire for the mom of the groom and mom of the bride may be very similar.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting20/research/accounting20-(25).html

Discover one of the best marriage ceremony guest outfits for men and women for all seasons.

https://chinavisa5.fra1.digitaloceanspaces.com/research/chinavisa5-(21).html

You don’t need to purchase a mother-of-the-bride costume if the considered it sitting untouched in your closet after the massive day is unappealing.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa5/research/chinavisa5-(204).html

The beaded flowers down one aspect add a tactile touch of luxury to the column costume .

https://chinavisa6.b-cdn.net/research/chinavisa6-(464).html

This bride’s mom escorted her down the aisle in a floor-length golden robe with a floral overlay.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa5/research/chinavisa5-(220).html

Think in regards to the colors you feel finest in and the sorts of outfits that make you shine.

https://storage.googleapis.com/chinavisa38/research/chinavisa38-(171).html

There often aren’t any set guidelines when it comes to MOB outfits for the wedding.

https://course147.z24.web.core.windows.net/research/course147-(141).html

For moms who swoon for all things sassy, the dramatic gold mom of the bride costume can be the picture-perfect pick in 2022.

https://accounting6.research.au-syd1.upcloudobjects.com/research/accounting6-(49).html

A navy cut-out overlay added a cool geometric sample to a blush pink skirt.

https://chinavisa43.z7.web.core.windows.net/research/chinavisa43-(27).html

An imported diamond in the tough, the Adrianna Papell Floral Beaded Gown is a real stunner.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa6/research/chinavisa6-(490).html

The mom of the bride costume gallery has a gown for each finances and each physique kind together with plus sizes.

https://chinavisa41.z8.web.core.windows.net/research/chinavisa41-(429).html

It has over a hundred and forty optimistic evaluations, many from ladies who wore this to a marriage and liked it!

https://accounting8.b-cdn.net/about/

We’ve rounded up some of the pretty Mother-of-the-Bride clothes to wear for spring weddings.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa2/research/chinavisa2-(202).html

I can assure you that I will never make that mistake once more.

https://accounting18.fra1.digitaloceanspaces.com/research/accounting-18-(216).html

If you are seeking to splurge on a MOB costume, you’ll discover loads of glam options here.

https://accounting2.research.au-syd1.upcloudobjects.com/research/accounting2-(28).html

Our Mother of the Bride Dresses assortment will fit any finances and style and flatter any shape or dimension.

https://accounting3.research.au-syd1.upcloudobjects.com/research/accounting3-(384).html

The bride’s aunt was just as modern in a Reem Acra quantity with lace and sheer ruffles.

https://accounting-5.sgp1.digitaloceanspaces.com/research/accounting5-(141).html

This is more of a personal choice that’s determined between you and your daughter.

https://accounting1.research.au-syd1.upcloudobjects.com/research/accounting1-(257).html

Maybe she envisions everyone sporting neutral tones, or perhaps she prefers bold and shiny.

https://chinavisa5.fra1.digitaloceanspaces.com/research/chinavisa5-(314).html

When unsure, go for somewhat black dress—but make it super luxe.

https://accounting3.research.au-syd1.upcloudobjects.com/research/accounting3-(114).html

Pair the dress with impartial or metallic accessories to keep the rest of the look subtle and easy.

https://chinavisa13.b-cdn.net/research/chinavisa13-(477).html

The shape of your dress can cover everything from a small bust to giant hips.

https://accounting1004.s3.us-west-004.backblazeb2.com/research/accounting1004-(226).html

Embroidery is a timeless pattern, and it’s never hoped to go out of favor.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa6/research/chinavisa6-(403).html

Jovani Plus dimension mom of the bride dresses fits any physique type.

https://accounting7.research.au-syd1.upcloudobjects.com/research/accounting7-(19).html

The dress has flattering loose chiffon sleeves, a relaxed tie waist, and complicated beading work.

https://accounting4.b-cdn.net/research/accounting4-(9).html

My daughter desires of a marriage on a seaside in Bali, so where will that depart me I wonder.

https://chinavisa4.b-cdn.net/research/chinavisa4-(411).html

Weddings could additionally be very completely different right now, relying on where you live.

https://storage.googleapis.com/chinavisa35/research/chinavisa35-(253).html

Some girls choose to wear a gown, whereas others favor separates…and both are great options!

https://chinavisa16.b-cdn.net/research/chinavisa16-(247).html

If yow will discover one thing with flowers even when it’s lace or embroidered.

https://storage.googleapis.com/chinavisa23/research/chinavisa23-(258).html

Sometimes, the most basic and elegant mother of the bride outfits aren’t attire at all!

https://accoungting16.sfo3.digitaloceanspaces.com/research/accounting-16-(274).html

This mother selected a royal blue gown with an illusion neckline and a floral overlay for a striking big-day look.

https://chinavisa42.z29.web.core.windows.net/research/chinavisa42-(6).html

Take inspiration from the bridesmaid attire and communicate to your daughter to get some concepts on colours that may work nicely on the day.

https://storage.googleapis.com/chinavisa36/research/chinavisa36-(316).html

Embroidery is a timeless development, and it’s by no means hoped to go out of favor.

https://chinavisa6.s3.us-west-004.backblazeb2.com/research/chinavisa6-(40).html

Black is just about accepted nowadays, irrespective of the occasion.

https://accounting3.b-cdn.net/research/accounting3-(176).html

For the mom who likes to look put together and modern, a jumpsuit in slate grey is sure to wow.

https://accounting017.netlify.app/research/accounting017-(46)

Jovani is a classy but easy brand that caters to the modern woman.

https://storage.googleapis.com/accounting0012/research/accounting0012-(47).html

You can even coordinate with the MOB to make sure your selections complement each other.

https://chinavisa4.s3.us-west-004.backblazeb2.com/research/chinavisa4-(139).html

Keep things basic or attempt variations of the shades,

like a champagne, rose gold, or shimmery charcoal.

https://chinavisa1.s3.us-west-004.backblazeb2.com/research/chinavisa1-(11).html

Gone are the times when mothers of the bride were expected to wear matronly clothes in washed-out shades of pastels or beige.

https://accoungting16.sfo3.digitaloceanspaces.com/research/accounting-16-(171).html

There are concepts here on the method to wear pants for the mother of the bride.

https://chinavisa5.s3.us-west-004.backblazeb2.com/research/chinavisa5-(77).html

For the mom whose fashion is sleek and minimal, opt for a

robe with an architectural silhouette in her favorite shade.

https://chinavisa3.sfo3.digitaloceanspaces.com/research/chinavisa3-(199).html

Looking for the proper inspiration on your mother of the bride look?

https://accounting1011.s3.us-west-004.backblazeb2.com/research/accounting1011-(121).html

Clean traces and a formed waist make this a timeless and stylish

mother of the bride dress with a flattering silhouette.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa3/research/chinavisa3-(145).html

No, you shouldn’t match with bridesmaids; as a substitute, complement them.

https://chinavisa4.ams3.digitaloceanspaces.com/research/chinavisa4-(189).html

Talk to your daughter or future daughter- in-law to get a feel for the visible she’s trying to create.

https://accounting0025.z5.web.core.windows.net/research/accounting0025-(25).html

This material is nice as a outcome of it lays flattering and appears nice in pictures.

https://course156.z4.web.core.windows.net/research/course156-(40).html

Here’s a tea-length mother-of-the-bride gown you’ll be able to simply pull out of your wardrobe time and time once more.

https://chinavisa1.s3.us-west-004.backblazeb2.com/research/chinavisa1-(179).html

Metallics are a fantastic various to neutrals, as are floral prints in complementary hues.

https://accounting24.b-cdn.net/research/accounting24-(8).html

We carry brands that excel in mother of the bride jacket dresses, capes and pantsuits, like Alex Evenings, R&M Richards and Ignite.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting5/research/accounting5-(147).html

Speak with the bride to get her thoughts on this and see what’s out there in outlets and online.

https://chinavisa6.blr1.digitaloceanspaces.com/research/chinavisa6-(126).html

Browse by scoop necklines or try the strapless choices.

https://accounting6.b-cdn.net/research/accounting6-(148).html

They have been excited about it since childhood, planning every…

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa1/research/chinavisa1-(261).html

This mother of the bride wore a white tunic and skirt for a boho-chic ensemble.

https://accounting1012.s3.us-west-004.backblazeb2.com/research/accounting1012-(84).html

This candy and elegant midi with a built-in cape would look just as chic paired with an evening shoe as it might with a floor-length maxi.

https://accounting0014.z1.web.core.windows.net/research/accounting0014-(21).html

Always dress for comfort and to please what the bride has in thoughts.

https://storage.googleapis.com/chinavisa28/research/chinavisa28-(190).html

The finest mom of the bride clothes fill you with confidence on the day and are snug sufficient to put on all day and into the night time.

https://chinavisa3.s3.us-west-004.backblazeb2.com/research/chinavisa3-(302).html

Choose a timeless look, similar to a mermaid fishtail gown.

https://accounting0007.z23.web.core.windows.net/research/accounting0007-(35).html

If you are looking to splurge on a MOB gown, you will discover plenty of glam options right here.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting9/research/accounting9-(235).html

Embroidery artfully placed in vertical traces elongates a woman’s silhouette, making mothers look taller, longer, and leaner.

https://chinavisa41.z8.web.core.windows.net/research/chinavisa41-(291).html

Gold, black or navy shoes and accessories would look stylish.

https://accounting002.netlify.app/research/accounting002-(113)

Draw inspiration from mix-and-match bridesmaid dresses by selecting a colour that coordinates with, however would not precisely match, the maids palette.

https://chinavisa3.sfo3.digitaloceanspaces.com/research/chinavisa3-(304).html

We love spring colours like blush, gold, pale green, and blue along with floral prints for mom of the bride dresses for spring weddings.

https://accounting18.b-cdn.net/research/accounting18-(46).html

I can assure you that I will never make that mistake again.

https://chinavisa5.s3.us-west-004.backblazeb2.com/research/chinavisa5-(191).html

Our top-rated sizes vary from 00 – 32 to also embrace petite products.

http://accounting0001.s3-website-us-east-1.amazonaws.com/research/accounting0001-(91).html

I was very impressed to see that there are elegant and stylish outfits for all plus measurement ladies.

https://storage.googleapis.com/chinavisa37/research/chinavisa37-(180).html

Grab superb online offers on mother of the bride dresses now and get free delivery within the United States.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa2/research/chinavisa2-(444).html

MOB etiquettes say if black flatters you, all–black could be your go-to mother of the bride or mom of the groom in search of the big day.

https://accounting013.netlify.app/research/accounting013-(301)

Not positive the place to begin out with your search for that picture-perfect mother-of-the-bride dress?

https://storage.googleapis.com/chinavisa32/research/chinavisa32-(58).html

Tadashi Shoji is a good name to look out for should you’re on the hunt for a designer costume.

https://chinavisa2.nyc3.digitaloceanspaces.com/research/chinavisa2-(394).html

From neutral off-white numbers to bold, punchy, and fashion-forward designs, there’s one thing right here that will suit her fancy.

https://chinavisa40.z1.web.core.windows.net/research/chinavisa40-(42).html

So, we’ve compiled a information to the best mother of the bride outfits and tendencies for 2022.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa4/research/chinavisa4-(469).html

Jovani is a trendy yet simple model that caters to the trendy girl.

https://storage.googleapis.com/chinavisa33/research/chinavisa33-(107).html

Talk about colour, sample, style, and level of formality so your dresses really feel harmonious.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting10/research/accounting10-(277).html

You can go for prints, and flowers should you like that type.

https://chinavisa2.nyc3.digitaloceanspaces.com/research/chinavisa2-(208).html

No, you shouldn’t match with bridesmaids; instead, complement them.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting21/research/accounting21-(174).html

In addition, many kinds can be found with matching jackets or shawls for final versatility.

https://chinavisa6.blr1.digitaloceanspaces.com/research/chinavisa6-(276).html

Modest meets insanely fashionable in this silky Amsale robe featuring a column silhouette and off-the-shoulder neckline.

https://accounting25.b-cdn.net/research/accounting25-(193).html

Are you looking for mother of the bride gowns for summer time seashore wedding?

https://chinavisa5.s3.us-west-004.backblazeb2.com/research/chinavisa5-(106).html

Embroidery artfully placed in vertical lines elongates a lady’s silhouette, making mothers look taller, longer, and leaner.

https://chinavisa2.b-cdn.net/research/chinavisa2-(289).html

Another floral choice for you , but this time in a fit and flare type.

https://accounting1011.s3.us-west-004.backblazeb2.com/research/accounting1011-(32).html

You can always add a wrap should you don’t wish to exhibit your arms.

https://chinavisa11.b-cdn.net/research/chinavisa11-(104).html

These gowns are chic and stylish with just a bit of an edge.

https://chinavisa5.s3.us-west-004.backblazeb2.com/research/chinavisa5-(125).html

Ask your son for his enter, and/or reach out to your future daughter-in-law to assist you pick a dress.

https://storage.googleapis.com/catering17/research/catering17-(559).html

And finally, don’t worry about looking to only ‘age-appropriate’ boutiques.

https://chinavisa1.s3.us-west-004.backblazeb2.com/research/chinavisa1-(122).html

A matching white choker topped off this mother-of-the-bride’s look, which was additionally complemented by a chic low bun.

https://chinavisa1.s3.us-west-004.backblazeb2.com/research/chinavisa1-(201).html

However, to discover out whether or not you should also coordinate with each mothers, check in with the bride.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa3/research/chinavisa3-(59).html

Peach, crimson, and gold introduced punchy colour to a standard Indian sari.

https://accounting8.research.au-syd1.upcloudobjects.com/research/accounting8-(264).html

You will wish to discover one thing that works in both hot and cold, or discover one thing to keep you heat to go over it.

https://accounting012.netlify.app/research/accounting012-(476)

Clean traces and a shaped waist make this a timeless and stylish mom of the bride costume with a flattering silhouette.

https://chinavisa5.fra1.digitaloceanspaces.com/research/chinavisa5-(158).html

As a mom of a daughter who is already married, the purchasing for both her dress and mine was one of the highlights of the marriage planning.

https://chinavisa4.b-cdn.net/research/chinavisa4-(317).html

This mother selected a royal blue robe with an illusion neckline and a floral overlay for a hanging big-day look.

https://chinavisa5.fra1.digitaloceanspaces.com/research/chinavisa5-(233).html

An occasion as particular as your child’s marriage ceremony doesn’t come around every day.

https://storage.googleapis.com/chinavisa27/research/chinavisa27-(34).html

Celebrate their big day in type with our Mother of the Bride or Groom outfits.

https://storage.googleapis.com/catering36/research/catering36-(13).html

With a delicate match on the hips, this dress is designed to flatter you in all the proper locations.

https://chinavisa6.b-cdn.net/research/chinavisa6-(183).html

This mother’s knee-length patterned costume perfectly matched the temper of her kid’s outside marriage ceremony venue.

https://chinavisa5.fra1.digitaloceanspaces.com/research/chinavisa5-(139).html

This will full your outfit and bring it collectively as an entire.

https://chinavisa15.b-cdn.net/research/chinavisa15-(117).html

A hint of sheen makes pastels like this dove grey feel rich and applicable for the night.

http://chinavisa30.s3-website-us-west-1.amazonaws.com/research/chinavisa30-(109).html

Frumpy, shapeless mother of the bride attire are a factor of the past!

https://chinavisa2.b-cdn.net/research/chinavisa2-(230).html

I was very impressed to see that there are classy and stylish outfits for all plus dimension girls.

http://chinavisa53.s3-website.me-central-1.amazonaws.com/research/chinavisa53-(331).html

Shop now via numerous retailers, including official on-line stores.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting21/research/accounting21-(388).html

If you like your legs, you might wish to go along with an above-the-knee or just-below-the-knee gown.

https://chinavisa40.z1.web.core.windows.net/research/chinavisa40-(253).html

Then, let the formality, season and venue of the marriage be your guide.

https://chinavisa15.b-cdn.net/research/chinavisa15-(465).html

Many of the choices above would assist you to to cover somewhat bit of a tummy.

https://storage.googleapis.com/chinavisa35/research/chinavisa35-(172).html

The straight hemline on the backside falls simply above the ankles and the sleeves stop proper after the elbows.

https://chinavisa5.b-cdn.net/research/chinavisa5-(29).html

Florals set on black or dark backgrounds feel no

less romantic however actually bring the delightfully surprising.

https://chinavisa1.sfo2.digitaloceanspaces.com/research/chinavisa1-(348).html

Express your love with handmade Valentine’s crafts like paper cards, reward concepts, and decorations.

https://storage.googleapis.com/chinavisa32/research/chinavisa32-(178).html

This materials is great as a outcome of it lays flattering and looks great in pictures.

https://chinavisa1.b-cdn.net/research/chinavisa1-(128).html

Make it pop with a blinged-out pair of heels and matching equipment.

https://chinavisa3.s3.us-west-004.backblazeb2.com/research/chinavisa3-(313).html

If you favor impartial tones, gold and silver clothes are promising decisions for an MOB!

https://chinavisa2.b-cdn.net/research/chinavisa2-(448).html

Stylish blue navy dress with floral pattern lace and wonderful silk lining, three-quarter sleeve.

https://storage.googleapis.com/catering21/research/catering21-(312).html

It’s out there in three colors and in sizes 0-18 and might be good for summer, destination, and bohemian weddings.

https://catering0006.s3.us-west-004.backblazeb2.com/research/catering0006-(347).html

This bride’s mother escorted her down the aisle in a floor-length golden robe with a floral overlay.

https://chinavisa44.z11.web.core.windows.net/research/chinavisa44-(2).html

They have been excited about it since childhood, planning each…

https://accounting001.netlify.app/research/accounting001-(287)

There are concepts here on how to wear pants for the mother of the bride.

https://chinavisa53.z36.web.core.windows.net/research/chinavisa53-(504).html

Discover the best wedding guest outfits for men and women for all seasons.

https://chinavisa2.nyc3.digitaloceanspaces.com/research/chinavisa2-(457).html

This is one element of the attire that do not have to match, as long as the formality is coordinated.

https://objectstorage.ap-tokyo-1.oraclecloud.com/n/nrswdvazxa8j/b/chinavisa6/o/research/chinavisa6-(251).html

Another costume with ruching for you as I suppose ruched types are so flattering.

https://objectstorage.ap-tokyo-1.oraclecloud.com/n/nrswdvazxa8j/b/chinavisa1/o/research/chinavisa1-(178).html

This mom’s knee-length patterned gown completely matched the mood of her child’s outside wedding ceremony venue.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa6/research/chinavisa6-(486).html

Did you know you could save an inventory of the mother of the bride dresses you want with a PreOwned account?

https://chinavisa5.fra1.digitaloceanspaces.com/research/chinavisa5-(227).html

You ought to remember the formality, theme, and decor colour of the wedding whereas on the lookout for the gown.

https://accounting1019.s3.us-west-004.backblazeb2.com/research/accounting1019-(197).html

We’ve all the time heard that mother is conscious of greatest, and if these mothers of the bride—and moms of the groom!

https://storage.googleapis.com/chinavisa35/research/chinavisa35-(75).html

Check out our options for petite mother of the bride dresses!

https://chinavisa16.b-cdn.net/research/chinavisa16-(162).html

With over 5 years of experience in bridal, she is an professional

on all issues fashion.

https://accounting1020.s3.us-west-004.backblazeb2.com/research/accounting1020-(115).html

The monochrome design creates a streamlined look, whereas crystals, beads and sequins add simply the appropriate amount of razzle-dazzle.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting13/research/accounting13-(144).html

It’s available in a spread of colors, from “champagne” (off-white) to navy.

https://accounting1007.s3.us-west-004.backblazeb2.com/research/accounting1007-(77).html

The next thing you should think about when purchasing round for dresses is the shape of the dress.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting4/research/accounting4-(207).html

The monochrome design creates a streamlined look, while crystals, beads and sequins add simply the right amount of razzle-dazzle.

https://storage.googleapis.com/accounting0019/research/accounting0019-(88).html

You’ll find understated A-line dresses and fabulous sheath numbers.

https://storage.googleapis.com/chinavisa36/research/chinavisa36-(166).html

Summer mother of the bride clothes tend to be full of bright floral patterns that look nice.

https://storage.googleapis.com/chinavisa28/research/chinavisa28-(82).html

You can nonetheless embrace those celebratory metallic shades without overlaying your self head to toe in sequins.

https://chinavisa47.z9.web.core.windows.net/research/chinavisa47-(361).html

This dress, as its name suggests, is incredibly elegant.

https://chinavisa1.sfo2.digitaloceanspaces.com/research/chinavisa1-(367).html

The bride’s mother clearly had the colour palette in thoughts when she selected this jade lace costume.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting16/research/accounting16-(37).html

We’re in love with the muted florals on this romantic mother-of-the-bride robe.

https://chinavisa4.s3.us-west-004.backblazeb2.com/research/chinavisa4-(79).html

The straps and sleeves you select in your costume will have an effect on the neckline and shape of your gown.

https://chinavisa3.sfo3.digitaloceanspaces.com/research/chinavisa3-(184).html

Regardless of her preference, likelihood is she has one, so be sure to know what it’s.

https://storage.googleapis.com/catering35/research/catering35-(100).html

Tadashi Shoji is a good name to look out for should you’re on the hunt for a designer dress.

https://chinavisa43.z7.web.core.windows.net/research/chinavisa43-(163).html

Much like the mom of the groom, step-mothers of both the bride or groom ought to observe the lead of the mom of the bride.

https://accounting22.b-cdn.net/research/accounting22-(162).html

Dresses are made in beautiful colors corresponding to gold, red, and blue and mom of the bride dresses.

https://storage.googleapis.com/chinavisa30/research/chinavisa30-(111).html

The neckline of the costume will affect everything from the shape of the gown to which areas of your physique are highlighted.

https://objectstorage.ap-tokyo-1.oraclecloud.com/n/nrswdvazxa8j/b/chinavisa1/o/research/chinavisa1-(456).html

However, many fashionable women use this recommendation as more of a suggestion than a strict rule.

https://accounting2.b-cdn.net/research/accounting2-(128).html

Browse by way of the brand new assortment of Mother of the Bride gowns 2021.

https://storage.googleapis.com/chinavisa25/research/chinavisa25-(312).html

The next thing you should consider when buying round for dresses is the form of the costume.

https://chinavisa50.z38.web.core.windows.net/research/chinavisa50-(58).html

Guests love to look at the joy and pride appear on your face as you watch your daughter marry their finest pal.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/chinavisa4/research/chinavisa4-(309).html

Our Mother of the Bride Dresses features a vast assortment of formal robes

and dresses that fit into any finances.

https://chinavisa2.s3.us-west-004.backblazeb2.com/research/chinavisa2-(358).html

Embroidery artfully positioned in vertical lines elongates a girl’s silhouette, making mothers look taller, longer, and leaner.

https://chinavisa45.z12.web.core.windows.net/research/chinavisa45-(464).html

It is customary to avoid carrying white in your children’s wedding day.

strona internetowa tutaj

https://storage.googleapis.com/chinavisa34/research/chinavisa34-(100).html

There are ideas here on tips on how to wear pants for the mom of the bride.

https://chinavisa4.ams3.digitaloceanspaces.com/research/chinavisa4-(230).html

We asked some wedding ceremony trend specialists to discover out what a MOB ought to wear on the big day.

https://storage.googleapis.com/chinavisa29/research/chinavisa29-(204).html

Do you favor to put on mild and airy colors or do you gravitate toward darker shades?

https://storage.googleapis.com/chinavisa28/research/chinavisa28-(139).html

One reviewer mentioned they wore a white jacket over the top but you could also select a wrap or bolero.

https://accounting0019.z1.web.core.windows.net/research/accounting0019-(20).html

So, we’ve compiled a guide to the most effective mother of the bride outfits and trends for 2022.

https://storage.googleapis.com/catering24/research/catering24-(300).html

Ask your son for his enter, and/or attain out to your future daughter-in-law that can assist you pick out a dress.

https://storage.googleapis.com/chinavisa27/research/chinavisa27-(99).html

But for others, it’s restrictive, it feels too formal, and sometimes, it ends up being quite costly too.

https://storage.googleapis.com/chinavisa36/research/chinavisa36-(46).html

The complete assortment is crafted with high quality fabrics for weddings or some other special occasion!

https://chinavisa4.b-cdn.net/research/chinavisa4-(484).html

If yow will discover something with flowers even when it’s lace or embroidered.

https://digi0007.s3.us-west-004.backblazeb2.com/research/digi0007-(122).html

Much like the mom of the groom, step-mothers of each the bride or groom ought to observe the lead

of the mother of the bride.

https://accounting1004.s3.us-west-004.backblazeb2.com/research/accounting1004-(14).html

Following these easy pointers are positive to make the method go easily and efficiently.

https://accounting18.fra1.digitaloceanspaces.com/research/accounting-18-(83).html

Knowing somewhat bit about what you’d wish to wear might help you slender down your decisions.

https://storage.googleapis.com/chinavisa26/research/chinavisa26-(17).html

So, in case your kids are internet hosting a black tie affair, make sure to put on a floor-length gown—preferably in a impartial tone .

https://accounting3.research.au-syd1.upcloudobjects.com/research/accounting3-(121).html

Embroidery is a timeless trend, and it is never hoped to go out of style.

https://chinavisa5.fra1.digitaloceanspaces.com/research/chinavisa5-(287).html

With over star evaluations, you could be positive this dress will exceed your (and your guests!) expectations.

http://digimarketing4.s3-website-us-west-2.amazonaws.com/research/digimarketing4-(56).html

For blogger Jenny Bernheim’s fancy rehearsal dinner, her mom wore a Carmen Marc Valvo gown, full with a beaded phantasm cut-out.

https://chinavisa9.netlify.app/about/

Cue the confetti as we’ve got EVERYTHING you need for the special occasion.

https://chinavisa5.research.au-syd1.upcloudobjects.com/research/chinavisa5-(187).html

Dresses are made in stunning colours such as gold, pink, and blue and mom of the bride dresses.

https://accounting002.netlify.app/research/accounting002-(8)

Check out the information for nice suggestions and ideas, and prepare to cut a touch at your daughter’s D-day.

https://chinavisa4.s3.us-west-004.backblazeb2.com/research/chinavisa4-(101).html

In addition, many types can be found with matching jackets or shawls for final versatility.

https://chinavisa3.research.au-syd1.upcloudobjects.com/research/chinavisa3-(209).html

Purchases made by way of links on this web

page may earn us a fee.

https://chinavisa3.research.au-syd1.upcloudobjects.com/research/chinavisa3-(441).html

Find jacket attire in champagne, orchid, pink, lavender, or navy for ladies of all ages.

https://chinavisa44.z11.web.core.windows.net/research/chinavisa44-(186).html

This fashion is finished with brief sleeves and a beneath the knee hem, and has a concealed centre back zip fastening.

http://catering101.s3-website-us-east-1.amazonaws.com/research/catering101-(356).html

That mentioned, having such a broad variety of choices might feel somewhat overwhelming.

https://chinavisa6.z12.web.core.windows.net/research/chinavisa6-(172).html

On the other hand, If you are curvy or apple-shaped, versatile dress kinds like a-line and empire waist will work wonders for you.

https://storage.googleapis.com/accounting0022/research/accounting0022-(17).html

Make a gorgeous impression in this floral printed ball gown featuring wrap-around ties that highlight your waist and helpful hidden pockets.

https://storage.googleapis.com/chinavisa31/research/chinavisa31-(249).html

If you’re undecided the place to begin (or you simply wish to see what’s out there), think about us your private stylist.

https://chinavisa12.z16.web.core.windows.net/research/chinavisa12-(167).html

This is more of a personal selection that’s determined between you and your daughter.

https://accounting0019.z1.web.core.windows.net/research/accounting0019-(30).html

The massive florals with the black background are significantly on development and the ruching provides a flattering factor.

https://catering6.research.au-syd1.upcloudobjects.com/research/catering6-(443).html

The shape of your dress can hide every little thing from a small bust to massive hips.

https://chinavisa47.z9.web.core.windows.net/research/chinavisa47-(518).html

From inexpensive and trendy to designer and traditional, these are our favourite bow ties for weddings.

http://digimarketing19.s3-website-ap-northeast-1.amazonaws.com/research/digimarketing19-(264).html

Black can also be another risky shade, however can work completely well at extra formal weddings.

https://storage.googleapis.com/chinavisa25/research/chinavisa25-(352).html

The form of your gown can hide everything from a small bust to large hips.

https://accounting0029.z31.web.core.windows.net/research/accounting0029-(10).html

Always dress for comfort and to please what the bride has in thoughts.

https://chinavisa2.nyc3.digitaloceanspaces.com/research/chinavisa2-(119).html

No, you shouldn’t match with bridesmaids; as a substitute, complement them.

https://accounting-6.blr1.digitaloceanspaces.com/research/accounting6-(143).html

Both the mom of the bride and the mom of the groom selected striking gowns with embellishment and phantasm necklines for this out of doors celebration.

Highly descriptive post, I loved that a lot. Will there be a part 2?

https://storage.googleapis.com/accounting0023/research/accounting0023-(84).html

So before I even go into detail mother of the bride outfit ideas, I want to emphasize one important thing.

https://storage.googleapis.com/chinavisa37/research/chinavisa37-(281).html

In addition, many styles are available with matching jackets or shawls for ultimate versatility.

https://filedn.eu/lXvDNJGJo3S0aUrNKUTnNkb/accounting24/research/accounting24-(221).html

Of course, there’s extra to your mom’s gown than just the pretty particulars.

https://accounting5.b-cdn.net/research/accounting5-(77).html

This material is great as a result of it lays flattering and looks nice in photographs.

https://chinavisa4.research.au-syd1.upcloudobjects.com/research/chinavisa4-(259).html

For moms who swoon for all issues sassy, the dramatic gold mother of the bride costume can be the picture-perfect pick

in 2022.

https://accounting010.netlify.app/research/accounting010-(225)

The factor concerning the gold hue is that it is naturally attractive!

https://storage.googleapis.com/catering3/research/catering3-(506).html

Beach weddings tend to be slightly more casual or bohemian in type than conventional weddings.

https://catering4.b-cdn.net/research/catering4-(163).html

Florals set on black or darkish backgrounds feel no much less romantic but definitely convey the delightfully sudden.

https://storage.googleapis.com/catering30/research/catering30-(498).html

Red Dress has some very lovely and elegant clothes, and they are inexpensive.

https://chinavisa9.b-cdn.net/research/chinavisa9-(460).html

The bridesmaids at this at-home Kentucky wedding sparkled in gold-sequined mini dresses.

https://storage.googleapis.com/catering6/research/catering6-(299).html

Are you looking for mother of the bride robes for summer seashore wedding?

https://accounting1007.s3.us-west-004.backblazeb2.com/research/accounting1007-(59).html

This will assist you to narrow down options, making the buying course of simpler.

https://objectstorage.ap-tokyo-1.oraclecloud.com/n/nrswdvazxa8j/b/chinavisa1/o/research/chinavisa1-(87).html

To make hers, mom JoJo Cohen turned to her shut friend, the late designer L’Wren Scott.

https://chinavisa13.b-cdn.net/research/chinavisa13-(91).html

One of the proudest and most anticipated days in a mother’s life is the day that

her daughter or son gets married.

https://accounting9.b-cdn.net/research/accounting9-(54).html

An event as special as your kid’s marriage ceremony does not come around every day.

https://storage.googleapis.com/catering39/research/catering39-(498).html

As versatile as is elegant, this icy blue frock is the perfect transition piece to take you from the ceremony to the reception.

https://chinavisa1.netlify.app/research/chinavisa1-(15)

This hard-to-beat basic type is seamless for mothers of all ages to flaunt an beautiful style statement on their daughter’s D-day.

https://chinavisa6.research.au-syd1.upcloudobjects.com/research/chinavisa6-(140).html

If you’re a Nordstrom common, you will be pleased to know the beloved retailer has an intensive collection of mother-of-the-bride dresses.

https://accounting-10.ams3.digitaloceanspaces.com/research/accounting10-(429).html

Mother of the groom attire are down to private selection on the day.

https://accounting-7.syd1.digitaloceanspaces.com/research/accounting-7-(372).html

« She bought it on a whim and ended up successful, » the bride stated.

https://accounting-7.syd1.digitaloceanspaces.com/research/accounting-7-(126).html

So, we’ve compiled a information to one of the best mother of the bride outfits and tendencies for 2022.

https://chinavisa8.b-cdn.net/research/chinavisa8-(414).html

One mom’s blush apparel appeared beautiful against these two

brides’ romantic wedding ceremony clothes.

https://accounting11.research.au-syd1.upcloudobjects.com/research/accounting11-(22).html

Jovani offers you the highest best quality MOB robes for a low price.

https://chinavisa10.b-cdn.net/research/chinavisa10-(424).html

It could additionally be your beloved has to attend to get married, or the event will be smaller.

https://storage.googleapis.com/digi7/research/digi7-(409).html

However, to find out whether or not you should also coordinate with each moms, verify in with the bride.

https://storage.googleapis.com/chinavisa23/research/chinavisa23-(319).html

Peach, crimson, and gold brought punchy colour to a conventional Indian sari.

https://storage.googleapis.com/catering14/research/catering14-(175).html

Karen Kane has beautiful choices that look slightly extra informal in case you are not looking for a full robe.

https://chinavisa45.z12.web.core.windows.net/research/chinavisa45-(236).html

Stylish blue navy costume with floral pattern lace and wonderful silk lining, three-quarter sleeve.